- Home

- /

- Thought Leadership Update

Zeldis Research has been privileged to work with hundreds of clients in our more than 25 years in the market research industry, representing many of the leading firms and organizations in their sectors.

We are proud to share here many of our publicly-released studies on topics of broader industry interest, particularly those capable of moving the industry forward, adding illumination, serving the broader public, and helping our clients demonstrate their industry leadership while deeply educating ourselves in industry topics of national or global interest.

This research includes studies conducted with and for Zeldis Research clients, as well as proprietary research conducted for ourselves.

This accumulated body of knowledge reflects our support and advocacy of our clients’ thought leadership in their fields, as well as our own deep industry experience.

We hope our clients and colleagues find the work below both inspiring and valuable for its application of innovative concepts, strategies and tools to their current challenges. Zeldis will continue to help our industry-leading clients leverage innovative research to deliver their insightful market strategies as well as contribute our own.

Zeldis is excited to announce upcoming thought leadership that looks at hot topics and challenges facing the insights industry across our areas of focus: healthcare and health insurance, financial services, P&C insurance, and group benefits.

We will be conducting one-on-one interviews with research and insights professionals at companies in these sectors to understand hot topics and areas of interest, how research is prioritized, new approaches, and more!

![]()

In today’s fast-paced digital age, where data collection is so often conducted online, phone surveys remain an effective quantitative methodology, and in some cases are making a justified comeback.

Zeldis Research is excited to share our perspective in a free webinar on March 6th, 2025, at 1pm ET. Learn more about how phone surveys can provide higher response rates, better data quality, more representation, and insights from narrow geographies.

In this podcast, Amy Rey discusses current trends in the group benefits industry and how they are shaping market research demands in this space.

With over 25 years of experience conducting qualitative and quantitative research with benefits professionals, group benefits brokers, and employees, Amy shares insights into how the market has evolved and highlight the key issues currently facing the industry.

The need for cyber liability insurance is greater now than ever, and small business owners (SBOs) are particularly vulnerable.

While small business owners are increasingly aware of their risk, insurance carriers need to provide support and resources in an accessible way. Zeldis will speak with SBOs across a range of industries to understand this ever-changing landscape and identify key needs.

In this Zeldis Buzz podcast, Amy Rey sat down with Zeldis Vice President and Financial Services Practice Lead, Kathrin Schumacher to talk about the recent research trends we’ve seen in the financial services market.

They talk some of the frequent topics and issues we’ve seen come up in investment and insurance research.

We are conducting qualitative research around how health insurance carriers can transition from the traditional role as a payer/gatekeeper to a clinical/wellness partner.

We are conducting qualitative research around how health insurance carriers can transition from the traditional role as a payer/gatekeeper to a clinical/wellness partner.

Using in-depth interviews with consumers, Zeldis will explore:

- Members’ views of their health plan as a clinical/wellness partner versus a payer/gatekeeper, and their reactions to how health plans are connecting clinically

- If health plans are a trusted resource for clinical/wellness information

- If health plans can support providers with clinical information or reminders

- What role health plans should play in social media by sharing clinical information, and what they need to know to have confidence in their health plan as a resource on clinical information

- Digital adoption/use of health plan mobile apps for clinical/wellness information

Online communities have become more and more popular in an environment where panel data quality can be a challenge.

Online communities have become more and more popular in an environment where panel data quality can be a challenge.

A full and robust online community, while offering many advantages, can also be a significant investment. In this webinar, Zeldis senior researchers will discuss the range of community options, from full-blown quantitative custom panels to smaller forums, and many options in between.

In this Zeldis Buzz podcast, Amy Rey, Managing Director at Zeldis Research talks about recent trends she’s seen in the market research industry over the last year through the work she’s done with clients and from conferences and events she’s attended.

In this Zeldis Buzz podcast, Amy Rey, Managing Director at Zeldis Research talks about recent trends she’s seen in the market research industry over the last year through the work she’s done with clients and from conferences and events she’s attended.

Amy talks about AI, data quality, thought leadership, and communities.

There is also a one-pager that summarizes the key points.

Social media is well-established as a powerful platform for connecting people, sharing ideas, and learning how to do just about anything. It is also where consumers can find a mountain of informaion on serious topics related to finances.

In fact, a recent study conducted by Forbes found that almost 80% of Millennials and Gen Z Americans have gotten financial advice from social media.

In this free webinar, we will cover recent Zeldis thought leadership qualitative and quantitative research that explored the role that social media plays in how consumers engage in financial education and advice.

In the newest Zeldis Buzz podcast, we sat down with Zeldis Health Insurance Practice Lead, Leanne Benvignati to talk about the recent trends we’ve seen in Health Insurance Market Research.

We talk about trends including an increased emphasis on government programs, a more holistic approach, and health insurance research in a post-pandemic world.

The dollars spent on market research are valuable – we all want to do everything possible to use those dollars to effectively make decisions that drive the business forward.

Learn about some techniques we have used with clients, both before and after the research execution, to elevate the effort, optimize stakeholder engagement and buy-in and make sure the research is activated after completion.

Zeldis is happy to launch our series of Zeldis Buzz Podcasts. The first in the series is a discussion between Amy Rey, Managing Director, and Zeldis colleagues, Kristina Witzling and Kathrin Schumacher, our P&C and Insurance and Investments Practice Leads, respectively.

Zeldis is happy to launch our series of Zeldis Buzz Podcasts. The first in the series is a discussion between Amy Rey, Managing Director, and Zeldis colleagues, Kristina Witzling and Kathrin Schumacher, our P&C and Insurance and Investments Practice Leads, respectively.

We discuss the importance of optimizing your research using techniques that lead to stakeholder investment and buy-in on the front end and effective research activation on the back end.

Kristina, Kathrin, and Amy discuss some examples of how we’ve worked with our clients do to this to make sure research dollars are being leveraged in the most impactful way possible.

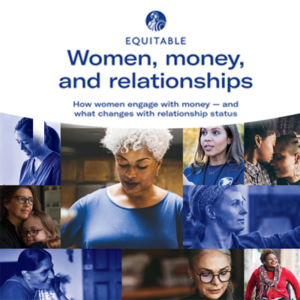

Zeldis was incredibly privileged to partner with Equitable for a two-phase research study that explored how women engage with money and how that differs and evolves based on their relationship status.

Zeldis was incredibly privileged to partner with Equitable for a two-phase research study that explored how women engage with money and how that differs and evolves based on their relationship status.

We collected quantitative data from 1702 respondents (1002 gen pop* women, 200 additional divorced and widowed women, and 500 men as a comparison group) and explored topics such as financial needs and behaviors, confidence and stress around managing finances, decision-making, and impact of professional financial advice.

In the U.S., many individuals provide care for a loved one. In fact, according to AARP, an estimated 38 million people, about 11.5% of the population, are taking care of loved ones in 2023.

The impact of caregiving takes a large toll on individuals’ physical, mental, social, and financial health. Zeldis Research conducted a two-phase qualitative and quantitative research study to understand the impact of this toll, exploring caregivers’ challenges, pain points, impacts, and needs.

Artificial Intelligence (AI) may not be omnipotent, but these days, it feels omnipresent.

You can’t scan the day’s news without seeing an article about Artificial Intelligence and how it is impacting our daily lives. It has made its way into many industries and occupations, and market research is no exception. The development and implementation of AI is moving rapidly, and we are trying to understand and keep up with the implications this has for the insights industry.

We don’t have all the answers, but we want to share some of what we’ve learned.

Zeldis recently presented select findings from a recently-released research we partnered on with the FINRA Investor Education Foundation and CFA Institute.

This comprehensive quantitative study looked at Gen Z consumers (18-25) and explored their financial attitudes and behaviors.

Our webinar focuses on the US Gen Z population, both independently, and how Gen Z investors compare to their millennial and Gen X counterparts.

As reported by Mental Health America, almost one in five people nationwide (47.1 million) are living with a mental health condition. That number increased by about 1.5 million over last year’s report.

As reported by Mental Health America, almost one in five people nationwide (47.1 million) are living with a mental health condition. That number increased by about 1.5 million over last year’s report.

Additionally, over half of adults with a mental illness do not receive treatment, totaling over 27 million adults in the U.S. who are going untreated.

This year we are exploring the experiences of those who accessed treatment for the first time and used teletherapy to open the door to counseling. The purpose of this thought leadership is to uncover the impact of teletherapy (video, chat, text, telephone) on accessibility, the customer experience, apps/tools, and intended future use of treatment options.

A 2020 article from Cushman Wakefield reports the rise of Generation Z as a potential “seismic shift” in the adaptation and usage of FinTech.

A 2020 article from Cushman Wakefield reports the rise of Generation Z as a potential “seismic shift” in the adaptation and usage of FinTech.

And according to a 2021 research study released by Plaid and the Harris Poll, the usage of FinTech has increased dramatically, from 58% usage in 2020 to 88% in 2021 – including 87% usage among Generation Z.

In this hybrid qualitative/quantitative research project, we will uncover unique insights about the overall Generation Z landscape within FinTech, ultimately generating insights that Financial and FinTech companies can use to better target their products and services to this group.

As reported by the North American Pet Health Insurance Association (NAPHIA) in its 2021 State of the Industry Report, North America’s pet health insurance sector exceeded $2.174 billion USD in 2020, as the industry recorded its sixth consecutive year of double-digit growth.

But only 1% of pets are insured in US compared to 25% in the UK and 40% in Sweden. Moving from 1% to just 5% of pets covered could represent a $5.2B opportunity.

In this study we examine consumers’ attitudes, behaviors, decision drivers and barriers to purchasing insurance for their beloved pets.

The role of women in home finances is changing.

The role of women in home finances is changing.

63% of women under the age of 45 are the financial decision-makers in their families, an unprecedented amount of assets will shift into the hands of US women over the next three to five years, and 70% of widows switch financial advisors within a year of their partner’s death.

And yet, only 15% to 20% of financial advisors are women. As a woman-owned business focusing on financial services/insurance, Zeldis is interested in exploring the barriers and challenges women face in the advisory industry and understand the unique qualities and strengths they may bring to the table.

Zeldis Research has extensive knowledge and experience researching Retirement and Medicare topics in custom studies for our clients.

Zeldis Research has extensive knowledge and experience researching Retirement and Medicare topics in custom studies for our clients.

We now further this knowledge through our own thought leadership research, exploring the many issues and priorities facing today’s retirees, including: financial planning, retirement income, longevity, Medicare and healthcare, long term care, and the impact of the COVID pandemic.

Telehealth for Behavioral Health – Is it here to stay?

With the increased usage of tele-therapy for behavioral health issues, Zeldis Research sought to understand the attitudes and perceptions of virtual and tele-therapy methods.

Qualitative research (individual interviews) was conducted with Behavioral Health (BH) providers and BH consumers in therapy to better understand their experience with and reactions to the movement toward a virtual/tele-therapy approach.

Consumers & Telemedicine

Telemedicine is considered a viable solution to improve healthcare delivery and outcomes, from closer monitoring of chronic disease to increasing convenience and access to lowering the overall cost of healthcare.

While health systems see the value and have been investing in telemedicine, consumer adoption has lagged behind.

Zeldis Research and Dynata have collaborated on a quantitative research study to gain insight into consumer barriers, misperceptions, facilitators and triggers for engagement with Telemedicine.

ESG Investing

Our 2019 initiative is the exploration of attitudes and perceptions about values-based investing, with a particular focus on environmental, social and corporate governance (ESG) investing.

This research will investigate the current knowledge and use of values-based investing and other emerging trends as well as motivators, barriers and differences by key subgroups, including generations, political leanings, and affiliations.

Consumerization of Health Care

Consumerization of health care—how we’ll be cared for and how we obtain care from providers—is front and center in the news.

Zeldis Research conducted both qualitative and quantitative research with consumers and physicians to understand how they are adapting to new technology (wearables, Consumer DNA test, remote health monitoring devices, and telemedicine) and other changes in health care.

Findings include the top needs and barriers to leveraging wearables and health apps among consumers and primary care physicians, as well as by generation.

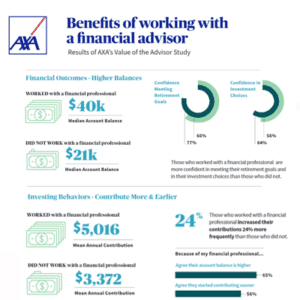

The Value of the Advisor: The Impact of Advisors on Financial Outcomes Among K-12 Educators

Some investors say they benefit from working with a professional financial advisor. But are there objective results that bear out these ‘good feelings?’

A new study by Zeldis Research and AXA Equitable helps quantify this impact with a comparison of savings, behaviors and confidence levels of 403(b) plan participants who work with a professional to those who do not.

Uncertain Futures, 7 Myths about Millennials and Investing

Millennials are on the cusp of surpassing Baby Boomers as the largest adult generation in America. Yet the soon-to-be largest generation in the nation remains substantially under-invested.

This report from the FINRA Foundation and CFA Institute, conducted by Zeldis Research Associates, explores the financial behaviors and attitudes of three millennial groups—those with no investment accounts, those with only retirement accounts, and those with taxable investment accounts (most of whom also have retirement accounts).

A Quantitative Segmentation of Millennial Customers

In addition to many negative stereotypes, ideas in pop culture might suggest that all Millennials are pretty much the same. In reality they’re not.

While Zeldis is not the first to segment Millennials, we approached our segmentation a little differently, learning from those who attempted before us, and avoiding the pitfalls of prior research segmentation attempts.

In this recent proprietary Zeldis research, you’ll gain some insights that may surprise about this important demographic, perceived often, and erroneously, as a homogeneous group.

![]()

Ready or not, the way we work is changing: automation, technology, and diversity of the workforce are only some of the dramatic forces impacting the U.S. business community. How are employers anticipating these changes? Are working Americans prepared for the new world of work (not enough of them, according to the study!) Even Millennials, more likely to adapt to workplace automation, will need more help in strengthening or acquiring new skills.

These are a few of the findings in the 5th Annual Guardian Workplace Benefits Study, released by Guardian and conducted by Zeldis Research Associates. The study was based on national online surveys of 2,000 employee benefit decision-makers, and 1,700 employees.

ARCHIVE OF PRIOR THOUGHT LEADERSHIP STUDIES

![]()

Success Reaching Consumers: Today and Tomorrow

Consumers are increasingly less brand loyal. So how can insurance companies appeal to these consumers and retain them? For Acxiom, Zeldis Research conducted an online quantitative survey to help understand the purchase drivers, expectations, and future plans of policy owners in purchasing life, auto, and home insurance and their differences among generations.

Ensure you’re keeping up with the fast-changing insurance shopping world.

A Shifting Perspective: The Voice of the Millennial Professional

This proprietary research study from Zeldis offers new insights into the unique needs of Millennial professionals, including small business owners, insurance agents, and financial advisors. Using a mix of IDIs and video interviews, the study focuses on how this population differs from their older counterparts, including their goals and motivations, use of technology, social media and other tools.

2016 Long-Term Care Awareness Study

Lincoln Financial Group’s 2016 Study, conducted by Zeldis Research, found that the majority of people approaching or in retirement, have not taken the necessary steps to prepare for an unanticipated long-term care event. In this online quantitative survey with consumer panels, the study explored consumer experience, perceptions, and knowledge of LTC.

![]()

SEE THE REPORT HERE:

Financial Advisors on Track to Implement New Department of Labor Rule Standards

A Nationwide Retirement Institute Survey conducted by Zeldis Research found that most advisors are considering changes to how they do business under the Department of Labor’s new fiduciary rules, moving to a service-oriented model from a transaction-based business. The study, surveying over 600 financial advisors, was commissioned to examine how the industry plans to expand services in the wake of the new regulations.

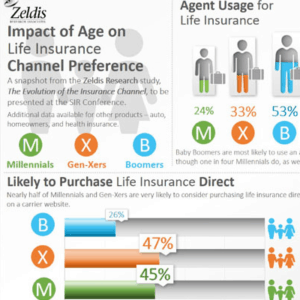

Learn how Boomers, Millennials, and GenXers purchase life insurance – differently!

The varying attitudes and approaches of these audiences towards buying life insurance are explored in “The Evolution of Distribution: Insurance Purchasing Preferences by Generation.” This study, based on an online quantitative survey of 500 consumers of at least one insurance product, found differences among the generations in usage of channels in purchasing insurance.

BIG I, FUTURE ONE COALITION

Independent insurance agencies in the U.S. have remained relatively stable, with continued growth in volume, but emerging purchase channels have become a top concern.

These are among the findings of the 2016 Agency Universe Study, a biennial research project sponsored by the Future One Coalition, a partnership of the Independent Insurance Agencies (Big I) and 17 major insurance agencies. The study examines how independent agencies operate, the types of technology and marketing tactics they deploy, their revenue, demographic and compensation metrics, and more.

The 2016 AUS was conducted for the third time by Zeldis Research with over 2,000 respondents. Zeldis Senior Research Directors co-managed the study with Madelyn Flannagan, VP, Agent Development, Education and Research for the IIABA.

![]()

![]()

On the rise: impact of a premature death, lack of life insurance.

A large-scale quantitative study conducted by Zeldis Research for MetLife found that the financial impact of premature death has increased. Fewer surviving spouses reported having life insurance, and more reported that death had a ‘major’ or ‘devastating effect’ on them.

I choose to order Xanax on https://drcatalona.com/buy-xanax/ because this online pharmacy is the best. I like everything about it: the prices, the simplicity of making an order, customer support, the professionalism of their pharmacists, fast delivery, and other small details we usually don’t even notice, but they play a huge role in the overall perception of the service.

Learn more about the mitigating effects of owning life insurance on premature death in a family and other findings of the MetLife study.

Insights from Survivors: Managing the Personal, Emotional and Financial Impact of Cancer

Life after cancer: The impact of this increasingly-survivable disease has often been understated. In this study commissioned by Washington National’s Institute for Wellness Solutions, Zeldis researchers explored the personal insights of 400 middle-income cancer survivors, including what worked (and didn’t) for them after their diagnoses, and their deeply personal insights into life after cancer.

![]()

Middle-Income America’s Perspectives on Critical Illness and Financial Security

In this large-scale quantitative survey of consumers who had experienced a serious medical condition, Zeldis Research helped Washington National’s Institute for Wellness Solutions understand the financial and other impacts of these illnesses on their lives. Findings included their perceptions of risk from illnesses, what sources of support and treatment they sought, how they prepared for the real costs of critical illnesses, and the role of critical illness insurance.